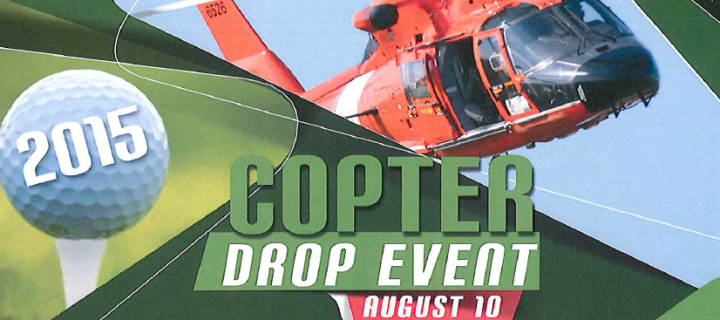

1,000 golf balls will be dropped from a helicopter and $9,000 in prize money will be given away to those whose golf balls are closest to the pins. Proceeds will benefit Hospice and The Resource...

Read MoreHealth Savings Accounts (HSAs): HSAs allow eligible individuals to make deductible contributions that can be withdrawn tax-free later to reimburse the individual for eligible medical expenses. For 2016, the limitation on HSA deductions is $3,350 for an individual with self-only coverage under a High Deductible Health Plan (HDHP) or $6,750 for an individual with...

Read MoreIRS Promoting Small Business Week: The IRS is spotlighting educational products for small business owners and self-employed individuals. The products include webinars and videos on topics including: (1) business use of your home, (2) avoiding the biggest tax mistakes, (3) depreciation basics, (4) child and daycare provider tax compliance, and (5) navigating the...

Read MoreEffective July 1, 2014 The thresholds for filing certain financial reports with the New York State Attorney General are as follows: Total Annual Gross Revenue & Support Report Required $500,000+ (*) Independent Cpas Audit $250,000 To $500,000 (**) CPA Review Report Up To $250,000 No Audit or Review is Required * the audit threshold will be raised to $750,000 as...

Read MoreProtecting Employers from Noncompliant Payroll Service Providers: Approximately 40% of small companies outsource part or all of their payroll function, including federal employment tax withholding, tax return preparation and filing, and tax payment responsibilities. While employers may outsource the function, they remain responsible for any unpaid tax, interest, and...

Read MoreIt’s tax time, which causes woes for some and joy for others — those expecting a refund. If you are among the lucky ones, you can track your refund. JMA makes it easy, just visit our Resources page to find out the status of your tax refund.

Read More